bad debt expense formula

Its not the entire 25000 that will be posted on the income statement but the movement or in other words the additional. Web Total interest cost.

|

| Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus |

Percentage of bad debt.

. The 2019 survey was made up of 2. In the percentage of the outstanding debtor Debtor A debtor is a borrower who is liable to pay a certain sum to a credit supplier such as a bank credit card company or goods supplier. Web Reduce your debt-to-income ratio. Web Using this number dividing by the accounts receivable for the period can show the exact percentage of bad debt.

Not only does it parse out which invoices are collectible and uncollectible but it also helps you generate accurate financial statements. For example if a company sells a total of 100. Web The bad debt expense formula to record the 1800 loss from Ace Retail Shoes under the allowance method requires two journal entries. Web Welcome to the team.

Web Comments and suggestions. Bad debt is usually a product of the debtor going into bankruptcy but may also occur when the creditors cost of. Return on equity ROE is the amount of net income returned as a percentage of shareholders equity. NW IR-6526 Washington DC 20224.

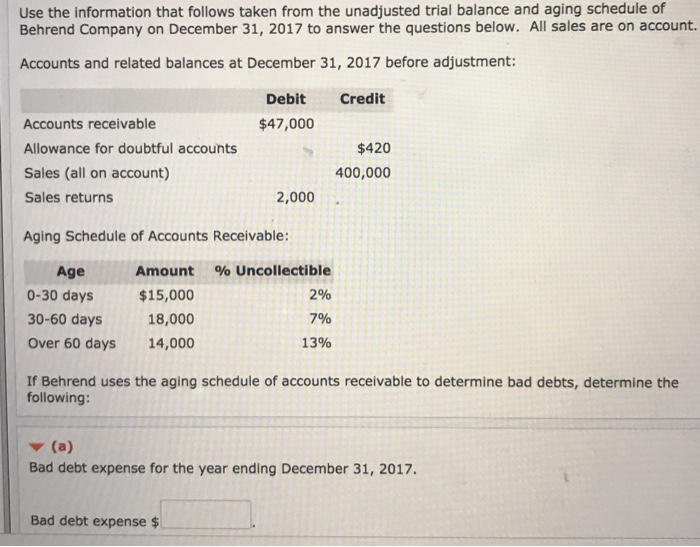

Return on equity measures a corporations profitability by revealing how. Web Read latest breaking news updates and headlines. Web Bad Debt Expense Formula Sale for Accounting Period Estimated of Bad Debts. Bad debt expense occurs as a result of a customer being unable to fulfill its obligation.

Usually management use the actual bad debt in the past to estimate the percentage of bad debt in the future. Web Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Get information on latest national and international events more. Web FCAC commissioned EKOS Research Associates to field the 2019 Canadian Financial Capability Survey CFCS using Probit a nationally representative hybrid onlinephone panelTo ensure the perspectives of all Canadians were reflected the sample was augmented by random-digit-dial phone interviews.

Gil Thorp comic strip welcomes new author Henry Barajas. Web How to calculate the bad debt expense. We also provide tools to help businesses grow network and hire. The bad debt expense formula.

Your debt-to-income DTI ratio is the debt you pay each month as a percentage of your gross monthly income. Aggregate debt at the end of a fiscal year Fiscal Year Fiscal Year FY is referred to as a period lasting for twelve months and is used for budgeting account keeping and all the other financial reporting for industries. Web All the latest breaking UK and world news with in-depth comment and analysis pictures and videos from MailOnline and the Daily Mail. What Net Realizable Value Is and a Formula.

We welcome your comments about this publication and suggestions for future editions. 2021-7-20 The company now thinks that a 25000 bad debt provision is necessary. Is the estimation by management which base on history data Accounts Receivable Aging report risk analysis on customers. Web Bad debt is debt that is not collectible and therefore worthless to the creditor.

It is nearly as significant as your credit score when. Web Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. There are two ways you can calculate bad debt expenses for your business. The borrower could be an individual like a home loan seeker or a corporate body.

Web 1 ETF That Could Turn 200 Per Month Into Nearly 250000 With Next to No Effort. Aggregate of interest expenses incurred by a firm in a year. Web Bad Debt Expense Formula. Calculating your bad debts is an important part of business accounting principles.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Web The Business Journals features local business news from 40-plus cities across the nation. Web Bad debt expense represents the amount of uncollectible accounts receivable that occurs in a given period. Some of the most commonly used Fiscal Years by.

Web Return On Equity - ROE.

|

| Bad Debt Overview Example Bad Debt Expense Journal Entries |

|

| What Is Bad Debt Write Offs And Methods For Estimating |

|

| Bad Debt Expense Calculator Calculator Academy |

|

| Net Accounts Receivable Percentage Of Sales Method Accounting Video Clutch Prep |

|

| How To Calculate The Allowance For Bad Debt Reserve Using The Percentage Of Sales Method Universal Cpa Review |

Posting Komentar untuk "bad debt expense formula"